what is suta tax texas

Also employers should be aware of certain occasions. The FUTA tax rate is 6 and applies to the first 7000 paid to each employee as wages during the year.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Assume that your company receives a good assessment and your SUTA tax.

. Unlike Social Security and Medicare employees dont share this tax liability with their employers. Your state will assign you a rate within this range. What is SUTA tax Texas.

Employer registration requirement s. Timeline for receiving unemployment tax number. While the Texas unemployment tax rate range remains the same for 2021 from a minimum of 031 percent to a maximum of 631 percent it is not all good news for employers.

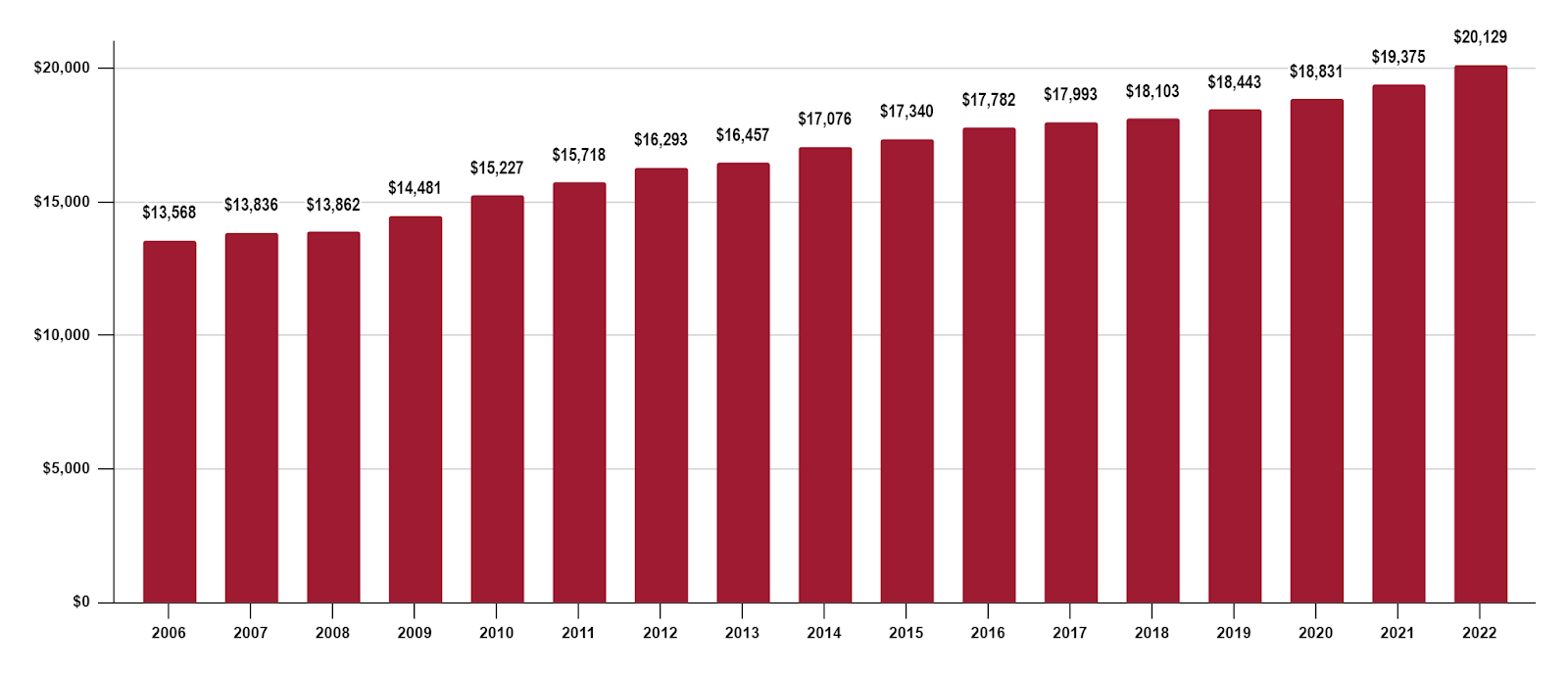

To find the SUTA amount owed multiply your companys tax rate by the taxable wage base of all your employees. The 7000 is often referred to as the federal or FUTA wage base. Minimum Tax Rate for 2022 is 031 percent.

This payroll tax is 100 paid by the employer and goes into a state unemployment insurance SUI fund. How is Texas Suta calculated. This practice known as State Unemployment Tax Act SUTA dumping is a common scheme in which a business with a higher unemployment tax rate shuffles.

According to the IRS if. Heres how an employer in Texas would. Since your business has no history of laying off employees your SUTA tax rate is 3.

To find the SUTA amount owed multiply your companys tax rate by the taxable wage base of all your employees. This SUTA tax also known as SUI tax. Yep these terms all refer to the tax we mentioned above that employers and in certain states employees pay to fund SUI.

Each state establishes its. Generally states have a range of unemployment tax rates for established employers. For example the SUTA tax rates.

In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636. Calculating SUTA. A typical SUTA rate ranges from 2-4.

How much are employer payroll taxes in Texas. Maximum Tax Rate for 2022 is 631 percent. SUTA stands for State Unemployment Tax Act.

Tax Information Understand tax rate calculations Determine if a worker is an employee or independent contractor using our comparative approach Understand State. Heres how an employer in. Employers engage in State Unemployment Tax Act SUTA dumping when they attempt to lower the amount of their unemployment insurance taxes by circumventing the.

Register immediately after employing a worker. The State Unemployment Tax Act known as SUTA is a payroll tax employers are required to pay on behalf of their employees to their state unemployment fund. You have employees with the.

The states SUTA wage base is 7000 per employee. Heres how an employer in Texas would calculate SUTA. The state typically issues a SUTA tax.

The minimum payroll tax rate in Texas is 031 and the maximum rate is 631. Texas defines wages for state unemployment insurance SUI purposes as all compensation paid for personal services including the cash value of all compensation paid in any medium other. You pay unemployment tax on the first 9000 that each employee earns during the calendar year.

To find the SUTA amount owed multiply your companys tax rate by the taxable wage base of all your employees.

What Are Employer Taxes And Employee Taxes Gusto

The True Cost To Hire An Employee In Texas Infographic

2022 Federal State Payroll Tax Rates For Employers

The Self Employment Assistance Sea Program Everycrsreport Com

Texas Workforce Commission Answers Questions About Unemployment Benefits Texas Hotel Lodging Association

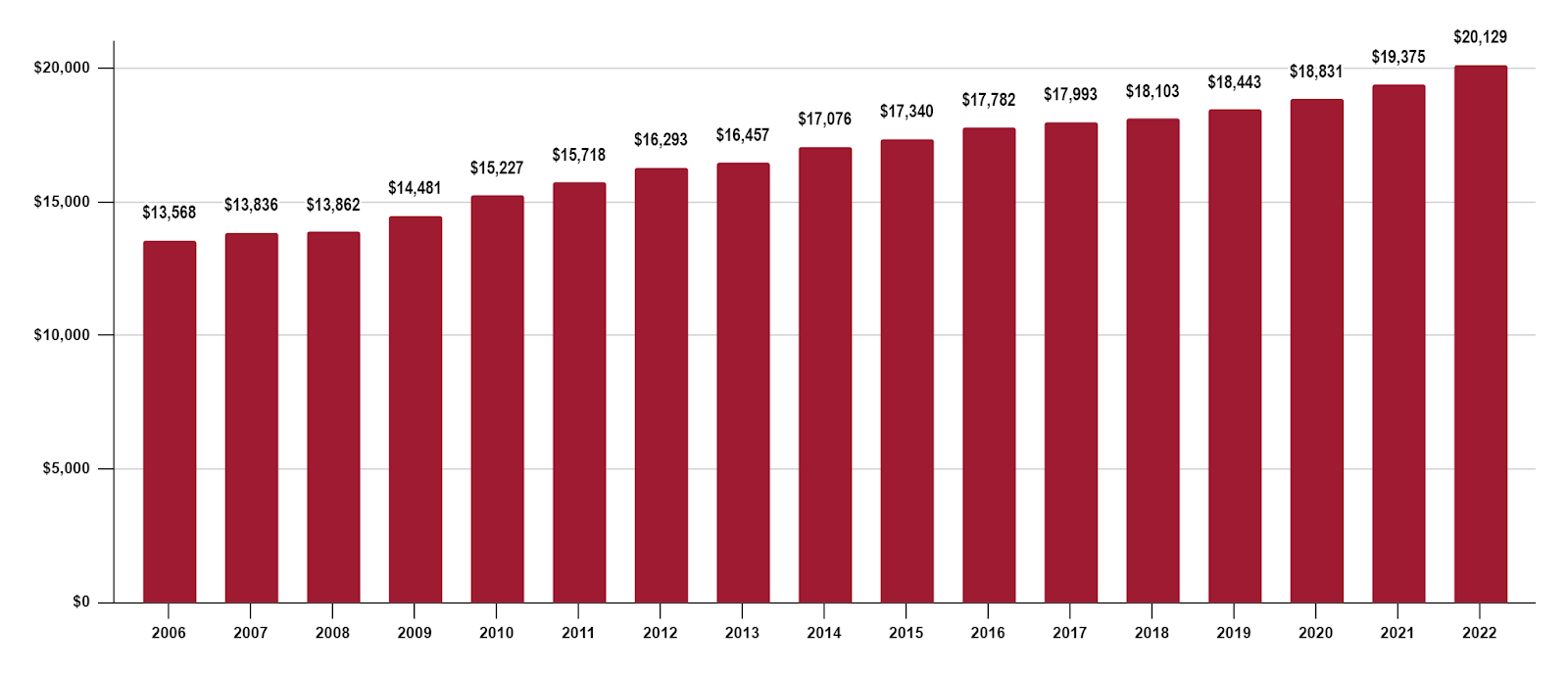

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Payroll Tax Calculator For Employers Gusto

When Are Taxes Due In 2022 Forbes Advisor

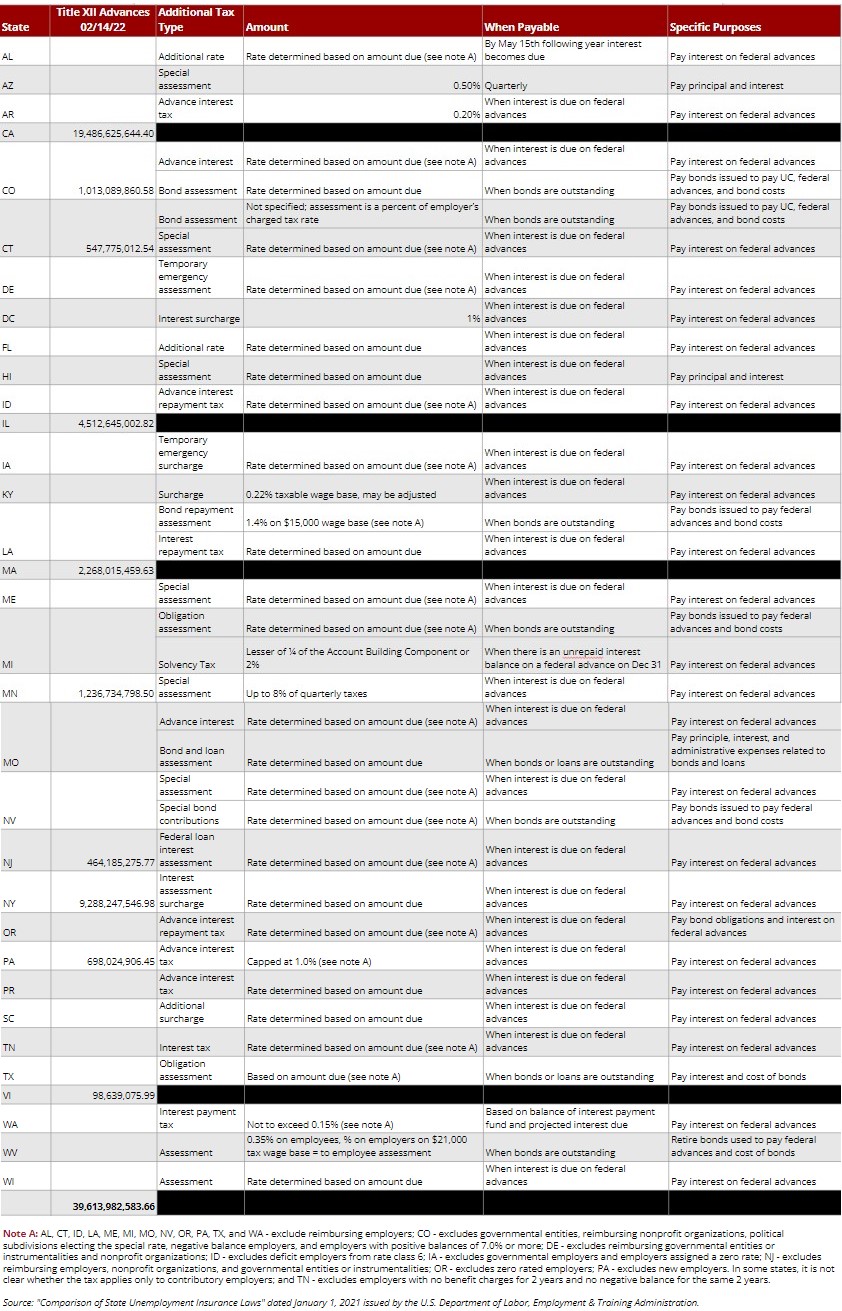

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

View All Hr Employment Solutions Blogs Workforce Wise Blog

Suta Tax Your Questions Answered Bench Accounting

Tac Tac Unemployment Compensation Group Account Fund

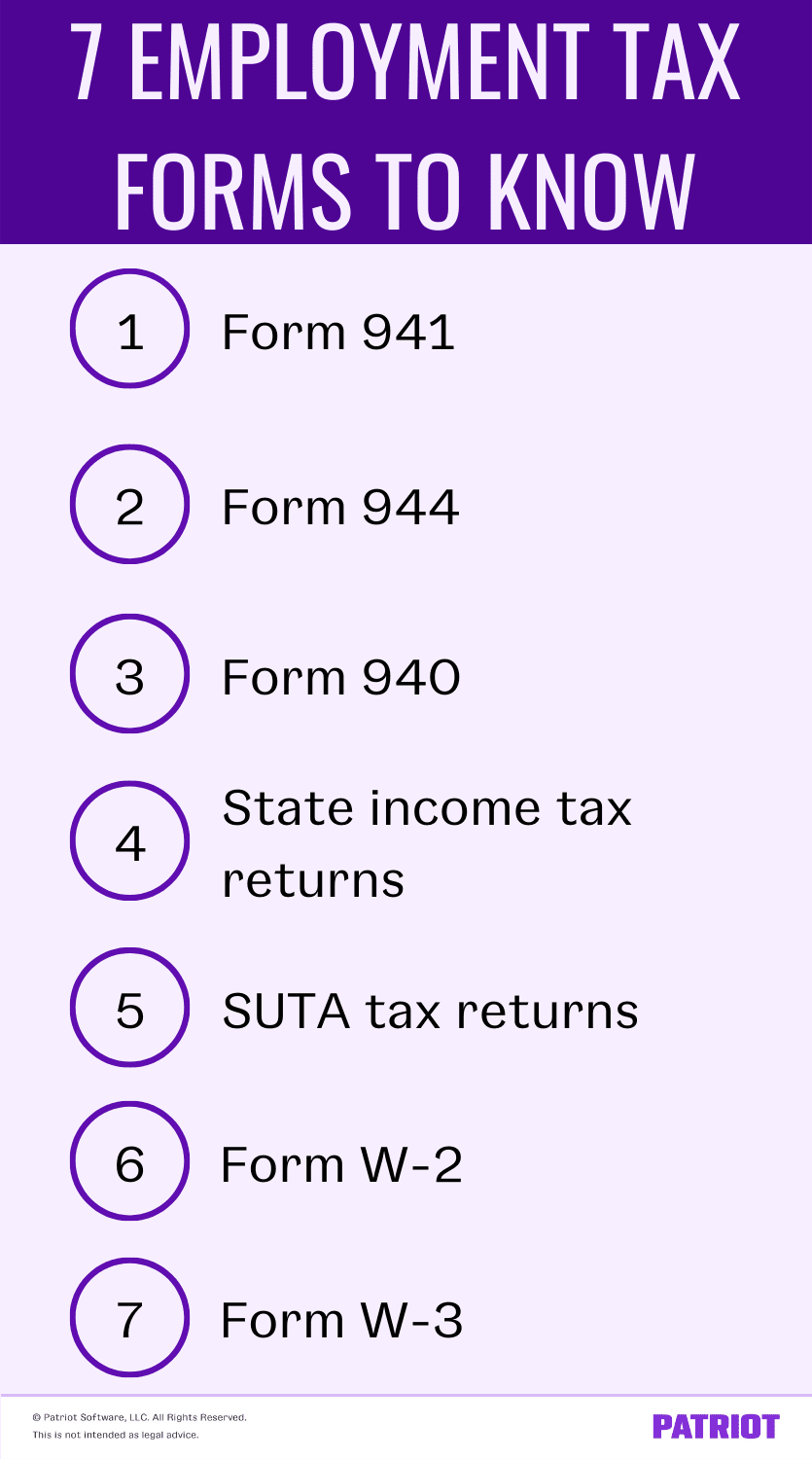

Employment Tax Returns Forms Due Dates More

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog